Unlocking Tax Breaks for Your Home Office

A Step-by-Step Guide to Understanding the Rules, Avoiding Common Pitfalls, and Successfully Claiming Deductions for Your Workspace

Welcome Back, Forward-Thinking Entrepreneurs! 🚀

Today we will dive into properly claiming your home office on your taxes. We'll explore the rules you need to know, steps to calculate your deductions accurately, and tips to avoid common pitfalls —all to help you make the most of your home workspace without any compliance worries. 🏠 💼

In an era when remote work is reshaping the business landscape, understanding how to maximize tax benefits from your home office is crucial. For savvy entrepreneurs aiming to legally reduce their tax burden, the home office deduction offers a valuable opportunity. This guide delves deep into the deduction's intricacies, providing advanced insights, detailed examples, and practical advice to help you unlock significant tax savings.

The Home Office Deduction: An Overview

The home office deduction allows qualifying taxpayers to deduct certain expenses related to the business use of their home. Strict IRS rules govern this deduction, but when applied correctly, it can result in substantial tax savings.

Key Qualification Criteria

Exclusive Use: You must use a portion of your home exclusively for business purposes, which means the space cannot be used for personal activities.

Regular Use: The area must be used regularly for business, not just occasionally.

Principal Place of Business: Your home office must be your primary place of business. Conducting substantial administrative or managerial activities from home may qualify even if you have another business location.

Important: The Tax Cuts and Jobs Act of 2017 eliminated the home office deduction for employees. Only self-employed individuals, independent contractors, and partners in a partnership can claim this deduction.

Deep Dive into Deductible Expenses

Understanding which expenses are deductible—and how to calculate them—is essential for maximizing your tax savings.

Direct vs. Indirect Expenses

Direct Expenses: Costs that are exclusively for the home office (e.g., painting the office, repairing the office window). These are fully deductible.

Indirect Expenses: Costs for maintaining and operating the entire home (e.g., mortgage interest, utilities, insurance). These are partially deductible, based on the percentage of your home used for business.

Comprehensive List of Deductible Expenses

Mortgage Interest and Property Taxes: The business portion is deductible in addition to the personal deduction on Schedule A.

Rent: If you rent your home, a portion of your rent is deductible.

Utilities: Electricity, gas, water, sewer, and trash removal.

Homeowners or Renters Insurance: A percentage of your premiums.

Depreciation: For homeowners, depreciation of the business portion of your home over 39 years.

Repairs and Maintenance: The costs of repairs that affect the entire home (e.g., roof repair) are partially deductible; those that affect only the office are fully deductible.

Security System: Monitoring fees and installation costs.

Advanced Tip: If you install a solar energy system, you may qualify for the Residential Energy Efficient Property Credit, and a portion of the credit can be attributed to your home office.

Calculating the Deduction: Regular Method Explained

The Regular Method requires meticulous calculations but often results in a larger deduction compared to the Simplified Method.

Step-by-Step Calculation

Measure Your Home Office: Determine the square footage of your home office space.

Measure Your Entire Home: Include all spaces except uninhabitable areas (e.g., unfinished basements).

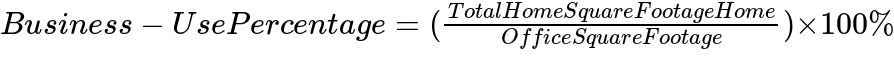

Calculate Business-Use Percentage:

Apply the Percentage to Indirect Expenses: Multiply each indirect expense by the business-use percentage.

Add Direct Expenses: Include any direct expenses in full.

Detailed Example

Scenario: You operate a consulting business from a dedicated home office.

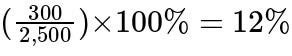

Home Office Size: 300 sq ft

Total Home Size: 2,500 sq ft

Business-Use Percentage:

Annual Indirect Expenses:

Mortgage Interest: $12,000

Property Taxes: $4,000

Utilities: $3,600

Homeowners Insurance: $1,200

General Repairs: $1,000

Direct Expenses:

Office Paint Job: $500

Calculation:

Indirect Expenses:

Mortgage Interest: $12,000 × 12% = $1,440

Property Taxes: $4,000 × 12% = $480

Utilities: $3,600 × 12% = $432

Insurance: $1,200 × 12% = $144

Repairs: $1,000 × 12% = $120

Total Indirect Expenses: $1,440 + $480 + $432 + $144 + $120 = $2,616

Direct Expenses: $500

Total Home Office Deduction: $2,616 + $500 = $3,116

Advanced Consideration: Depreciation

Adjusted Basis of Home: $300,000 (excluding land)

Business Basis: $300,000 × 12% = $36,000

Annual Depreciation (39-year straight-line method):

New Total Deduction: $3,116 + $923.08 = $4,039.08

Note: Depreciation recapture may apply when you sell your home, so consult with a tax professional.

The Simplified Method: When and How to Use It

The Simplified Method offers ease but may result in a smaller deduction.

Deduction Rate: $5 per square foot, up to 300 square feet.

Maximum Deduction: $1,500 per year.

Example:

Home Office Size: 300 sq ft

Simplified Deduction: 300 sq ft × $5 = $1,500

Analysis:

In the earlier example, the Regular Method yielded a deduction of $4,039.08, significantly higher than the Simplified Method's $1,500.

When to Use: The Simplified Method may be advantageous if:

Your home office is small.

You have low home-related expenses.

You prefer minimal record-keeping.

Advanced Strategies to Maximize Deductions

Optimize Your Business-Use Percentage

Dedicate Larger Spaces: If feasible, allocate a larger area exclusively for business.

Reassess Space Utilization: Convert underused areas into business space (e.g., storage for inventory).

Leverage Depreciation Wisely

Cost Segregation Studies: Break down property into components to accelerate depreciation.

Energy-Efficient Improvements: Invest in qualifying improvements for additional tax credits.

Combine with Other Deductions

Section 179 Deduction: Deduct the full cost of qualifying equipment in the year of purchase.

Bonus Depreciation: For certain property types, you can deduct a larger portion in the first year.

Navigating Common Pitfalls and IRS Scrutiny

The "Exclusive Use" Misconception

Myth: Occasional personal use is acceptable.

Reality: Any personal use disqualifies the space. Ensure the area is used solely for business.

Inadequate Documentation

Problem: Lack of records can lead to disallowed deductions during an audit.

Solution: Maintain detailed records, including:

Floor plans with measurements.

Logs of business activities conducted in the space.

Receipts and invoices for expenses.

Misclassification of Expenses

Direct vs. Indirect: Misallocating expenses can trigger red flags.

Advanced Tip: Use accounting software to categorize expenses accurately.

Overstating Business-Use Percentage

Risk: Claiming an unrealistically high percentage (e.g., 50% of your home) may invite IRS scrutiny.

Best Practice: Be honest and conservative in your calculations.

Audit-Proofing Your Deduction

Photographic Evidence

Action: Take timestamped photos of your home office setup.

Benefit: Provides tangible proof of exclusive business use.

Regular Updates

Action: Update your records annually or when significant changes occur.

Benefit: Keeps your documentation current and accurate.

Professional Appraisals

Action: Obtain a professional measurement of your home if needed.

Benefit: Eliminates disputes over square footage calculations.

The Impact on Home Sale and Depreciation Recapture

Understanding Depreciation Recapture

What It Is: Upon selling your home, the IRS may tax the depreciation deductions you've taken as unrecaptured Section 1250 gain, taxed at a maximum rate of 25%.

Example:

Total Depreciation Taken: $10,000

Depreciation Recapture Tax: $10,000 × 25% = $2,500

Strategies to Mitigate Impact

Plan Ahead: Be aware of potential tax implications when deciding to take depreciation.

Use Exclusions: The Section 121 exclusion allows you to exclude up to $250,000 ($500,000 if married filing jointly) of gain from the sale of your primary residence, but it doesn't apply to the depreciation portion.

Advanced Record-Keeping Techniques

Digital Solutions

Cloud Accounting Software: Use platforms like QuickBooks or Xero to track expenses.

Receipt Scanning Apps: Tools like Expensify or Receipt Bank help digitize and organize receipts.

Separate Business Accounts

Banking: Maintain a separate bank account and credit card for business expenses.

Benefit: Simplifies tracking and provides clear audit trails.

Staying Updated with Tax Law Changes

Tax laws evolve, and staying informed is key to maximizing benefits.

Monitor Legislation: Keep an eye on IRS announcements and tax reform bills.

Consult Professionals: Engage with tax advisors who specialize in small business taxation.

Education: Participate in webinars, workshops, and courses on tax strategies.

Case Studies: Applying Advanced Strategies

Case Study 1: Maximizing Deductions for a Home-Based Bakery

Background:

Business: Home-based bakery.

Use of Space: Dedicated kitchen space and storage totaling 500 sq ft.

Total Home Size: 2,000 sq ft.

Business-Use Percentage: 25%

Advanced Strategies Applied:

Cost Segregation: Identified and depreciated appliances and improvements over shorter lifespans.

Energy Credits: Installed energy-efficient ovens qualifying for tax credits.

Outcome: Increased deductions by 40% over standard calculations.

Case Study 2: Consultant Utilizing a Separate Structure

Background:

Business: Marketing consultant.

Home Office: Converted detached garage of 400 sq ft.

Total Home Size: 2,400 sq ft.

Business-Use Percentage: 16.67%

Advanced Strategies Applied:

Separate Utilities: Installed a separate meter for the office, allowing full deduction of utilities.

Direct Expenses: All renovation costs for the garage conversion were fully deductible.

Outcome: Maximized deductions and reduced overall taxable income significantly.

Conclusion: Empowering Your Financial Journey

By deepening your understanding of the home office deduction and applying advanced strategies, you position yourself to legally reduce your taxes and reinvest in your business's growth. This proactive approach not only enhances your immediate financial health but also contributes to your long-term goal of financial freedom.