Multi-Entity Structures for Asset Protection and Tax Savings

Using Holding Companies, Subsidiaries, and Cross-Border Strategies to Protect IP, Real Estate, and Revenue Streams

Hello, Dear Entrepreneurs!

In today's ever-evolving business landscape, setting up the right multi-entity structure can make or break your success. With rising litigation risks, aggressive IRS audits, and new cross-border tax regulations, entrepreneurs need advanced strategies that go well beyond a simple LLC. In this article, we’ll show you how sophisticated owners are leveraging layered holding companies, intercompany IP licensing, and risk-segmentation tactics to fortify their assets and slash their tax bills.

The 2025 entrepreneurial landscape is a minefield of litigation risks, aggressive IRS audits, international reporting obligations, and shifting tax rules. Sophisticated business owners leverage multi-entity “chessboard” formations to isolate liabilities, optimize tax treatment, and keep revenue streams flowing through the most favorable jurisdictions. While entry-level LLCs might work for hobby businesses, the top 1% earners are layering holding companies, intercompany licensing, and even cross-border subsidiaries to harness global advantages. Let’s dissect the advanced frameworks you should consider.

1. Hybrid Entity Selection: LLCs, C-Corps, and the S-Corp Twist

LLCs

Pass-Through Taxation Still King? Yes, for many small-to-medium operations, but the pass-through advantage wanes if you anticipate multi-million-dollar profits. Remember, the individual tax rate can top out at 37%—plus additional state taxes.

Risk of QBI Deduction Sunset: With the 20% Qualified Business Income Deduction set to expire after 2025, the effective pass-through advantage might plummet. Advanced planners are exploring partial conversions of LLC interests to C-Corp structures if the numbers pencil out.

C-Corps

Flat 21% Rate & Retained Earnings: Profits left inside a C-Corp aren’t taxed at individual rates. This retention strategy can fund expansions, acquisitions, or R&D.

Dividend Planning: If you distribute profits as dividends, expect double taxation. However, well-timed distributions—especially in lower-income years or strategic years with offsetting capital losses—can mitigate the overall burden.

International Expansion: When you have cross-border operations, a C-Corp’s structure can simplify foreign withholding tax planning and foreign-derived intangible income (FDII) deductions.

S-Corps

2025 Update: Although overshadowed by LLCs in prior years, S-Corps still provide pass-through taxation with self-employment tax savings on “reasonable salary” structures. But watch out for increased IRS scrutiny on “unreasonably low” salaries.

Ownership Restrictions: Nonresident aliens and certain trusts/LLCs cannot be owners. Complex advanced planning often merges S-Corps with trust vehicles that meet the eligibility rules.

2. Advanced Intercompany Licensing: Beyond Simple Royalties

Intercompany IP licensing is no longer a niche strategy; it’s a refined art with multi-layered compliance components.

Transferring IP to a Shell Holding LLC or C-Corp: You might place patents, trademarks, or software code in a separate entity domiciled in a 0% or low-tax state (Wyoming, Nevada) or even offshore in jurisdictions with favorable IP-box regimes.

Royalties and Management Fees: Beyond royalty payments, some companies charge “management fees,” “technical service fees,” or “platform access fees.” Each creates a deductible expense for the operating entity, shifting profits to the IP-holding company.

OECD Pillar Two and U.S. Nexus: Multinationals face new global minimum tax constraints. Still, if your operations are predominantly domestic, your exposure to these rules may be marginal—but do expect heightened IRS transfer pricing scrutiny on intercompany rates.

Pro Tip: Elevate your compliance game with transfer pricing documentation (e.g., full economic analyses under Section 482). The days of “napkin math” for royalty rates are gone; advanced valuations in the $10K–$20K range can pay off by reducing the risk of retroactive tax adjustments.

3. Real Estate & Risk Segmentation: Moving from Single-Asset LLCs to Multi-Layered Series

Owning one property per LLC is just the starting point. The truly sophisticated approach extends to series LLCs, master holding companies, and specialized management LLCs:

Series LLC: A “parent” LLC with sub-series, each insulated from the liabilities of the others. This structure is recognized in states like Delaware, Nevada, and Illinois, but less so elsewhere—be mindful if you operate in multiple jurisdictions.

Master Holding Company: This top-tier entity owns the series LLC or individual LLCs. It centralizes corporate governance, financing, and strategic decision-making.

Property Management LLC: Manages operations (tenant interactions, maintenance, etc.) and bills each property LLC for services. This approach limits cross-liability claims and creates clearer expense documentation.

Advanced Tactic: Pair a management LLC with performance-based compensation structures. If your property management arm shows low profits (due to high deductible expenses), you shield more income in the holding companies or real estate LLCs.

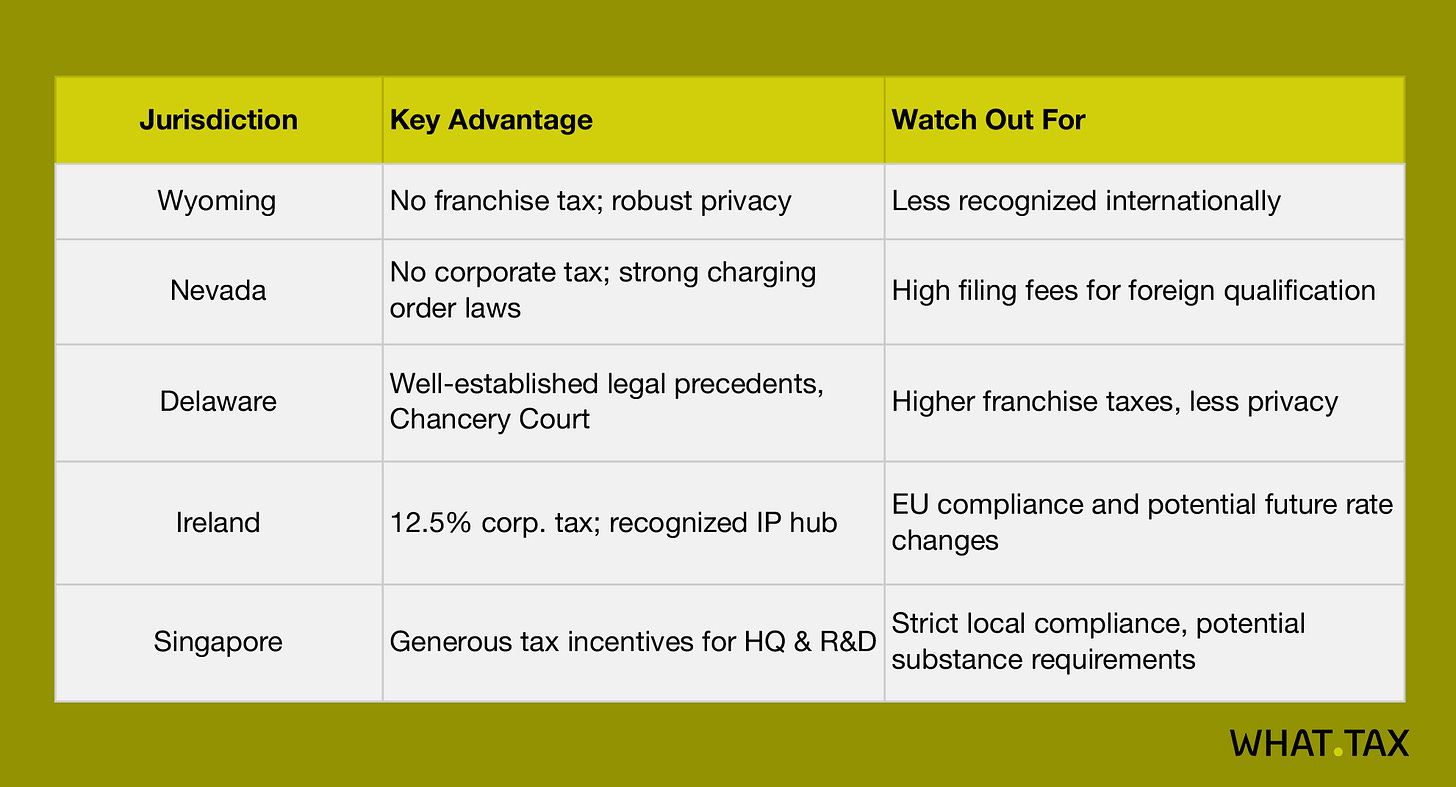

4. Strategic State (and International) Jurisdiction Selection

Domestic states like Wyoming, Nevada, and Delaware are still top contenders for privacy and tax flexibility, but global expansions have broadened the playing field:

Cross-Border Edge: By combining a U.S. parent entity with an Irish or Singaporean subsidiary, you might leverage low foreign corporate rates or IP-box regimes. However, post-2017 tax reform (GILTI rules) can impose U.S. taxes on foreign income; advanced structuring plus well-documented substance in the foreign jurisdiction are crucial.

5. Cost-Benefit Analysis: When Does It Pay Off?

Setting up multiple entities—especially across jurisdictions—brings front-loaded legal and compliance costs. Factor in:

Entity Formation: $2,000–$7,000 per domestic entity (more if you’re also incorporating cross-border structures).

Annual Maintenance: $1,500–$4,000 per entity (registered agents, tax returns, compliance fees, and possible foreign disclosures like FBAR or Form 5471).

Transfer Pricing & Valuation: $5,000–$25,000, depending on complexity.

ROI Threshold: If your net worth hits $1M+ or you foresee significant global revenue, advanced segmentation often yields 3:1 or higher returns—factoring in both asset protection and tax minimization.

6. The Crypto & Digital Asset Frontier: DAOs, Tokenized Assets, and More

As digital assets mature, simply holding crypto on an exchange in your name is too risky—both legally and fiscally.

DAO LLCs: Wyoming pioneered legally recognized DAO LLCs, blending smart contracts for governance with corporate formalities. Tax treatments vary; consult advanced crypto tax advisors for classification (e.g., partnership vs. corporation).

Tokenized Asset Structures: If you’re tokenizing real estate or IP rights, advanced multi-entity formations can handle compliance with SEC rules, manage royalty flows to token holders, and mitigate cybersecurity risks.

Bonus Insight: Trust Layer for Estate and Privacy

Ultra-high net worth individuals often add a trust component on top of these entity structures for estate planning and next-level privacy:

Domestic Asset Protection Trusts (DAPT) in states like Nevada or South Dakota can own the holding company.

Beneficial Ownership remains confidential, and you gain protection from certain creditors if set up correctly and well in advance of any claims.

Complexity and Opportunity in 2025

The IRS hauled in $688B in 2024, with a clear mandate to expand audits targeting sophisticated structures. But knowledge is power. By integrating detailed transfer pricing studies, bulletproof legal documents, and advanced jurisdictional planning, you can legally minimize taxation, protect your most valuable assets, and stay well ahead of regulatory scrutiny.